The highly volatile real estate market of 2025 presents buyers and renters nationwide with the ancient question of whether to purchase or rent property. The calmer interest rates combined with economic market adjustments and home-based work transformations have led to Property price evolution and lifestyle modifications. Homebuying or renting has reached a point of maximum complexity.

This comprehensive analysis of current buying and renting factors provides you with a complete system to choose a suitable path based on your financial situation lifestyle selection and future goals.

The Current Housing Situation

The 2025 housing market is shaped by conflicting forces that affect both homebuyers and renters. Several underlying trends are influencing how people choose between buying or renting. Interest rates, while lower than their recent peak, remain high compared to historical norms. The average 30-year fixed mortgage rate now stands at 5.8%, and this new baseline is shifting how housing affordability is calculated.

In terms of pricing, some areas have seen declines, while others have held steady or even gained. Overall, home prices have remained relatively stable despite previous market volatility. Regional trends vary widely—some areas are experiencing growth, while others are seeing only slight decreases.

The rental market has also stabilized. National average rents have grown 3.7% year-over-year, a more moderate pace compared to the sharp fluctuations seen in recent years.

Workforce trends continue to influence housing demand. With remote and hybrid roles now common across many industries, homebuyers are placing more value on space and lifestyle features rather than proximity to employment hubs.

Improvements in supply chains have helped boost new home construction, but most of the new inventory is focused on the entry-level segment.

If you’re deciding whether to buy or rent, consider your financial situation, job stability, lifestyle preferences, and local market conditions.

Financial Consideration

The Cost Equation in Today’s Market

Buying Costs

- Initial Investment: Buying a home starts with a large upfront cost. That’s why you need to know how much house you can afford. Typically, you’ll need to make a down payment ranging from 3% to 20% of the home’s purchase price. In addition, closing costs usually range from 2% to 5% of the loan amount. Buyers also need to consider immediate expenses for repairs or renovations to make the house livable and comfortable.

- Ongoing Expenditures: Homeownership comes with continuous financial responsibilities. The monthly mortgage payment mainly covers the loan’s principal and interest. Property taxes average about 1.1% of the home’s assessed value nationwide. Homeowners insurance costs around $1,800 per year. If the property is part of a homeowners association (HOA), fees can range from $200 to $700 per month, depending on location. Maintenance costs typically run about 1% to 3% of the home’s value annually, often higher than those for rental properties.

- Potential Tax Benefits: There are a few tax advantages to owning a home. Mortgage interest can be deducted, although its impact has been reduced due to the higher standard deduction. Property taxes are also deductible, but the amount is limited by state and local tax (SALT) caps. When selling, single filers may exclude up to $250,000 of capital gains from taxes, while joint filers may exclude up to $500,000—provided certain conditions are met.

Renting Costs

- Initial Investment: You need less money up front to sign a rental agreement. Security deposits are usually one month’s rent. We pay the first and last month’s rent as standard in most markets. Fees for the application and maybe a pet deposit will tack on a little more.

- Ongoing Expenditures: Rent is your biggest monthly bill. Renters Insurance, averaging $280 a year, is essential for the insurance you need. Services are different under every agreement, but renters usually pay less than homeowners for these utility charges.

- Tax Consideration: For most states, renting provides fewer tax benefits. On the downside, this means greater flexibility for other investments that can be used for tax optimization.

The Opportunity Cost Factor

Opportunity cost entails comparing the purchase to renting: what would you do with that available money in a down payment and all the other homeownership-related expenses that cannot be invested?

The average return on your diversified investment portfolio in 2025’s investment landscape is roughly ~7-8% annually. If you were to invest if it costs more each month to own your home (mortgage, taxes, insurance maintenance) as compared with the bottom line of rent, this may beat home appreciation in some markets.

The Break-Even Timeline

Break-even point — How the financial advantage of buying over renting is dependent on where you live, what type of property and individual financials. For the current climate, this ranges from ~2-3 years in high-growing share cities and markets with great rent-to-price ratios to ~5-7 years in stable moderate markets all up to the more expensive locations being closer to 8+ years where the purchase price is high relative to rents.

Online calculators that use current interest rates and the current market can tell you your break-even timeline estimates but these do not in any way guarantee returns.

Lifestyle and Flexibility Factors

When Renting May Better Fit Your Lifestyle

- Career Mobility: The constantly shifting employment sector. It calls for the workers to retain the opportunity for relocation from one place to another. Presently, the industries. Along with chosen career upgrades. Cannot be reached unless physically relocating to different areas with. Availability. Of remote work. Managing yours. Living space. Provides you. Mobility. Freedom. Without having. To endure the. Challenges that result. From. Sales of property. Or unforeseen ownership of rental. Estates.

- Life Transition: The capacity for renting becomes necessary for individuals who will undergo significant life changes over the next few years like marriage and childbearing or returns for education or providing care for aging family members.

- Minimal Maintenance Responsibility: Regularly maintaining the property is accompanied by financial outlay as well as knowledge and required time investments. In landlord regimes, you spare yourself property upkeep troubles and prepare for unforeseen fixed expenditures since you let the landlord undertake these responsibilities.

- Access to Amenities: The residential facilities offered in rental properties located in city centres and new developments are facilities that may be out of reach when purchasing a freestanding property.

- Financial Recovery or Building: Buying a house lets you keep a stable place to reside without the burden of homeownership costs when you need to fix your credit, consolidate debt, or save money.

When Buying May Better Suit Your Needs

- Desires for Stability: Homeownership gives control of your residential surroundings—no landlords raising rates, altering provisions, or electing not to renew leases. Such stability is especially worth paying for for school-age families or individuals who would like to begin making long-term connections in an area.

- Customization and Personalization: With ownership comes unlimited flexibility, from what colours to paint the walls to extensive renovations, having a place that perfectly represents your tastes and requirements without needing approval.

- Privacy and Autonomy: Owned homes generally provide more privacy and independence in matters relating to your home and lifestyle.

- Building Multi-Generation Wealth: For some families, homeownership is a chance to accumulate wealth to be passed from one generation to the next, especially among communities that have traditionally been excluded from property ownership.

- Tax Planning and Retirement Strategy: Homeownership can act as a forced savings mechanism and inflation shelter, with mortgage payments eventually vanishing in retirement when income generally drops.

Regional Market Analysis: Current Snapshot

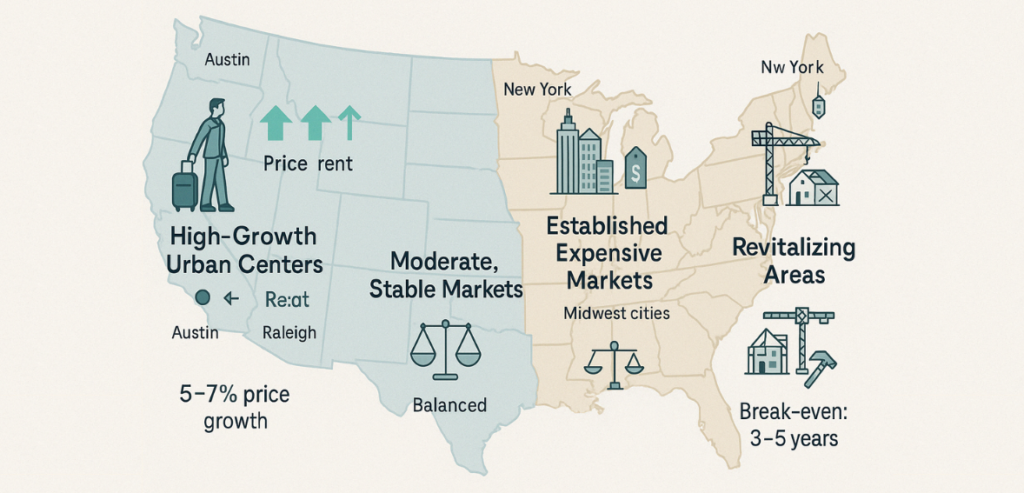

- High-Growth Urban Centers: Markets such as Austin, Nashville, Raleigh, and Salt Lake City are still witnessing solid population growth and economic expansion. In these markets, housing prices still appreciate at higher-than-average rates of 5-7% per year. Rent growth remains solid at 4-6% per year. New home construction is unable to keep up with demand. Purchasing generally becomes attractive sooner, often within 3-5 years. For those determined to stay in these places, purchasing frequently is a stronger long-term position, although entry prices can be daunting.

- Established Expensive Markets: Markets such as New York, San Francisco, Boston, and Seattle have a different equation. Very high purchase prices create substantial entry barriers. Rent-to-price ratios tend to favour renting from a pure monthly cash flow standpoint. Price appreciation has tempered to 2-4% per year. Break-even horizons tend to be longer than 7-10 years. In these markets, renting often gives access to locations and amenities that would be out of reach through purchase for most income levels.

- Moderate, Stable Markets: Most of the nation lies in markets of moderate growth and stability, such as most Midwestern cities, smaller cities, and suburban areas. Home appreciation usually follows inflation at 2-3% per year. Rent growth likewise moderates at 2-4% per year. More balance is seen between housing demand and supply. Break-even points typically range in the 5-7 year period. These markets often provide the most balanced consideration between buying and renting, with decisions hinging more on personal circumstances than market pressure.

- Revitalizing Areas: Previously undervalued cities and communities are being rejuvenated with distinctive opportunities. Such neighbourhoods offer lower entry points with the potential for better appreciation, upgraded amenities and infrastructure, favourable rent-to-price ratios, and potential tax incentives to homebuyers. These communities can represent strong buying possibilities for those ready to accept some ambiguity and invest in community revitalization, albeit flexibility in leasing the area permits a test run before buying.

The Remote Work Factor

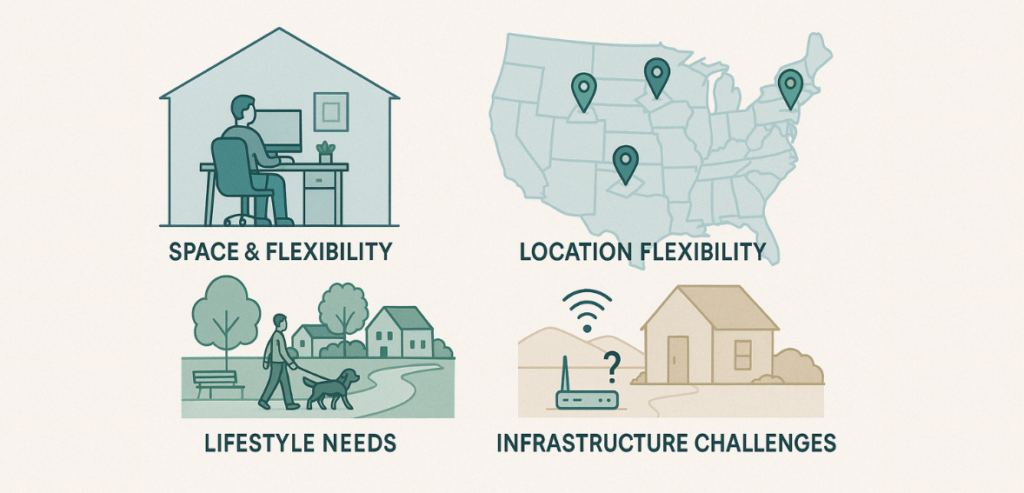

- Space Requirement: Flexible work from home typically requires a dedicated home office, so smaller rental units may not be convenient for most employees. Homeownership might give the square footage and flexibility needed for efficient working space.

- Location Flexibility: With commuting needs minimized or eliminated, most workers can now look at locations that were once impractical because of distance from job centres. This creates opportunities in lower-cost housing markets where purchasing becomes more feasible.

- Community and Amenities: When the home is both living and working space, distance from amenities that increase quality of life—parks, recreation centres, walkable communities—becomes more valuable than commute time. Both rental housing and ownership should be measured in these terms.

- Infrastructure Needs: Working remotely using reliable high-speed internet has now become a no-compromise. Certain rural districts provide good-looking housing at favourable prices but with no infrastructure facilities for reliable remote work, involving cautious consideration before purchase.

Special Consideration for Today’s Market

- Climate Resilience: Property valuation needs to incorporate long-term climate risk assessment since climate events now influence both property value and insurance costs at the time that homeowners make purchasing decisions. Insurance firms have aggressively increased their premiums in hazard-susceptible areas. Climate risk assessment by lenders is now a standard evaluation practice in their loan decision-making. Property taxation increases will take place as a result of financing needs for resilience infrastructure projects. The rental terms limit exposure to extended financial hazards.

- Energy Efficiency and Costs: Power use costs combined with future performance levels present economic adversity impacting both house ownership and rental real estate investment. Energy-efficient design and system elements are the norm in current rental buildings. Homeowners are required to cover initial fees for making their house energy-efficient although they reap benefits from the expenses. Homeowners receive benefits in terms of incentives from the government and state, which direct the financing of energy upgrades. Rental contracts more often transfer utility charges to renters.

- Housing Technology Integration: New smart home technology and connectivity now act as an expected norm in homes. Basic smart systems are standard equipment in homes that are rented out. Home buyers have full autonomy in designing their spaces the way they desire but also need to foot the bill for installation. The values of properties along with rental prices feel the impact of infrastructures formed by technology.

Making Your Decision: A Framework

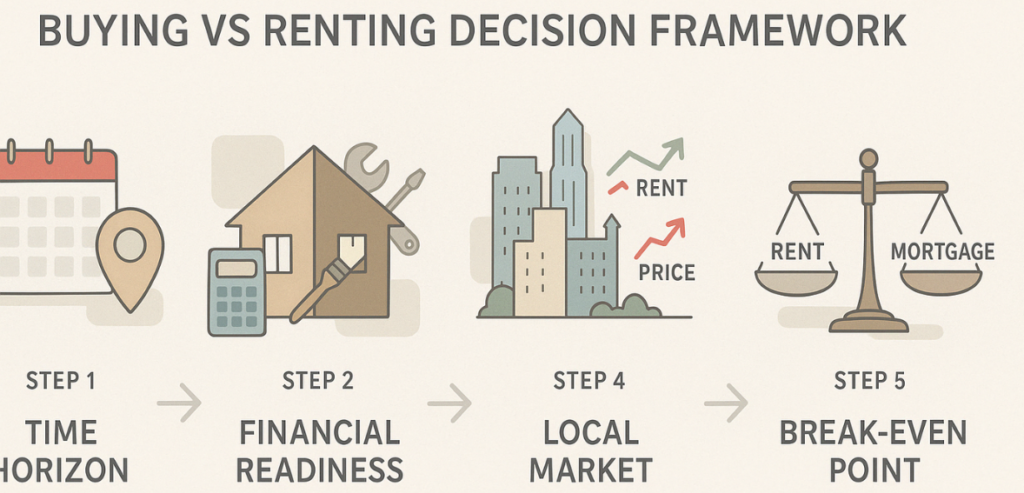

Step 1: Assess Your Time Horizon

How many years do you foresee yourself remaining in the same location? Your career path tells you if you can anticipate a stable environment or must be mobile. Do you have significant change plans on the horizon which may impact your current situation?

Step 2: Evaluate Your Financial Readiness

Are you established with funds meant to cover required upkeep in addition to unexpected outlays? Do you believe homeownership will affect your retirement savings as well as your other financial goals? All types of expenses need to be accounted for when comparing.

Step 3: Consider Your Lifestyle Priorities

Is your capability to customize and manage your home space a top priority for you? Your primary priority is having no responsibility for handling routine property maintenance tasks. The choice in reality fits how your work system harmonizes with your daily activities.

Step 4: Analyze Your Local Market

In which direction are housing prices and rents headed now and on what course they are likely to proceed? The rent-to-price ratio indicates in what position it finds itself compared to historical norms. Certain local elements make an appearance in the domestic markets to affect their makeup.

Step 5: Calculate Your Personal Break-Even Point

Engaging in active research in your desired field will enable you to determine the number of years you would need to own a property that would be more financially advantageous than renting where you are.

Conclusion

In 2025 the choice between renting and buying is largely based on personal financial circumstances along with personal tastes housing market prices and long-term intentions. The cultural acceptance of renting as a legitimate alternative option substituted the former preference for homeownership as the primary basis for wealth building for the majority of Americans.

The most effective approach involves reviewing your specific situation with objective evaluation as to what housing choice constitutes “success.” The decision between purchasing or leasing homes is a dual advantage system where one option is superior to the other depending on individual requirements.

Your rental choice should be viewed as temporary rather than permanent. Working Americans rent real estate at certain phases and purchase ownership at other life points to fulfil needs that change over time. Housing success comes when you align present life requirements with long-term objectives regardless of their long-term plan.